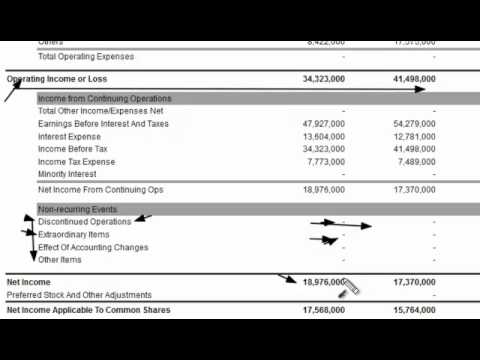

Transactions that are above the material limit of an organization will classify under extraordinary items of the company. Some of the critical aspects are: Materiality In other words, they pertain to transactions that do not form a part of the day-to-day business operations of the company. Features of Extraordinary ItemsĮxtraordinary items refer to gains and losses from specific business transactions, which are unusual and rare from the normal course of business. However, when we remove the extraordinary items from the Income Statement, the Net Profit gets reduced to RMB 2,072 million. We note that Net profit Attributable to Shareholders is RMB 2,633 million. Let us have a look at the ZTE Annual Report.

Extraordinary Items refers to those events which are considered to be unusual by the company as they are infrequent in nature and the gains or losses arising out of these items are disclosed separately in the financial statement of the company during the period in which such item came into the existence.

0 kommentar(er)

0 kommentar(er)